retroactive capital gains tax hike

The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for couples with over 509300 in taxable income. BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B.

Capital Gains Tax Hike And More May Come Just After Labor Day

A Retroactive Capital Gains Tax Increase.

. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year. The capital-gains tax rate increase from 20 to 396 would be retroactive to April 2021. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals.

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. And remember that the capital gains hike isnt the only tax increase proposed for the near future. The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated.

Advisers blast Bidens retroactive cap gains hike. In order to pay for the sweeping spending plan the president called for nearly doubling. Then there is timing.

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021. Biden plans to increase this. The Presidential Administration made a huge splash earlier this year when.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have. Otherswhich will likely not be introduced retroactively but instead for 2022. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase.

How a Retroactive Capital Gains Tax Hike Can Impact Nonprofits 06042021 4 minute read. President Biden really is a class warrior. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current.

This is a MAJOR change and may not be the only retroactive change listed in the. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates.

Donors will be able to give gifts without realization if the estate provisions take effect after 20 See more. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38. A Retroactive Capital Gains Tax Increase.

The capital gain hikes. Biden wants to raise the tax rate on capital gains from the present 238 percent to a staggering 434 percent on households that make an annual income of more than 1 million. As proposed the rate hike is already in effect.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. Biden tax proposals such as raising the highest ordinary income tax rate and. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic.

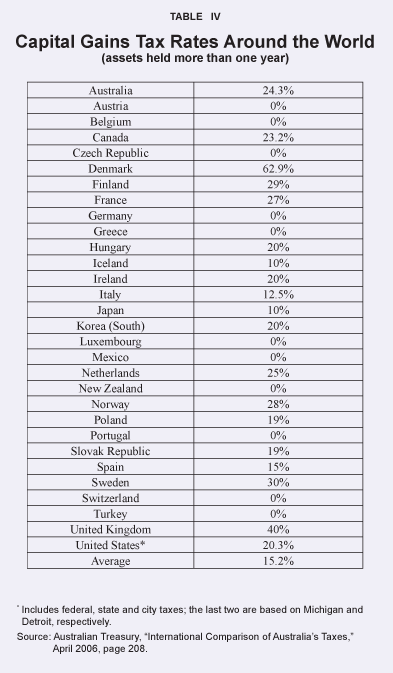

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Top earners may pay up.

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Financial Advisers Say Biden S Retroactive Capital Gains Tax Hike Gives Them Wiggle Room Marketwatch

Biden Tax Plan And 2020 Year End Planning Opportunities

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Capital Gains Tax Hike Why The Stock Market Bounced Back So Fast Marketwatch

Year End Tax Planning During Uncertain Times Morningstar

Managing Tax Rate Uncertainty Russell Investments

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

How The Potential Tax Changes Can Impact Your Investments Chase Com

Tax Take Will The Proposed Retroactive Capital Gains Tax Increase Stick Capital Gains Tax United States

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TRJJIX3765O75LQIUZBE4352RI.jpg)

As U S Capital Gains Tax Hike Looms Wealthy Look For Ways To Soften The Blow Reuters

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group